Best No KYC Crypto Exchanges: Top Crypto Exchange Without KYC in 2025

In the evolving landscape of cryptocurrency trading, privacy remains a significant concern for many investors. No KYC crypto exchanges offer a solution for those seeking to trade digital assets without the extensive identity verification processes required by traditional platforms. This comprehensive guide explores the best no KYC crypto exchanges in 2025, their features, benefits, and important considerations for privacy-conscious traders.

What Are No KYC Crypto Exchanges?

No KYC (Know Your Customer) crypto exchanges are trading platforms that allow users to buy, sell, and trade cryptocurrencies without submitting personal identification documents. These exchanges prioritize user privacy and anonymity, enabling traders to access cryptocurrency markets without revealing their identity.

Traditional exchanges typically require users to complete verification processes that include submitting government-issued IDs, proof of address, and sometimes even biometric data. In contrast, no KYC exchanges either eliminate these requirements entirely or implement tiered systems where basic trading functions are accessible without verification.

Why Choose a No KYC Crypto Exchange?

Several compelling reasons drive traders toward no KYC platforms:

Enhanced Privacy Protection

Privacy-focused traders appreciate the ability to maintain anonymity in their financial transactions. No KYC exchanges help protect personal information from potential data breaches and unauthorized access.

Faster Onboarding Process

Without lengthy verification procedures, users can begin trading almost immediately after creating an account. This streamlined approach eliminates the waiting periods often associated with KYC verification.

Global Accessibility

No KYC exchanges typically serve users from more regions, including those where traditional financial services may be limited or restricted. This inclusivity makes cryptocurrency more accessible to the global population.

Protection from Identity Theft

By minimizing the personal data shared online, traders reduce their exposure to identity theft risks and other cybersecurity threats that target financial platforms.

1. LBank: The All-Around Champion

LBank has emerged as a leading no KYC exchange in 2025, offering an impressive selection of over 1,500 cryptocurrencies. The platform features:

- Intuitive user interface suitable for beginners and experienced traders

- Competitive trading fees starting at just 0.1%

- Robust security measures including cold storage for user funds

- Advanced trading options including futures and margin trading

- Comprehensive mobile app for trading on the go

Visit LBank to explore their extensive cryptocurrency offerings.

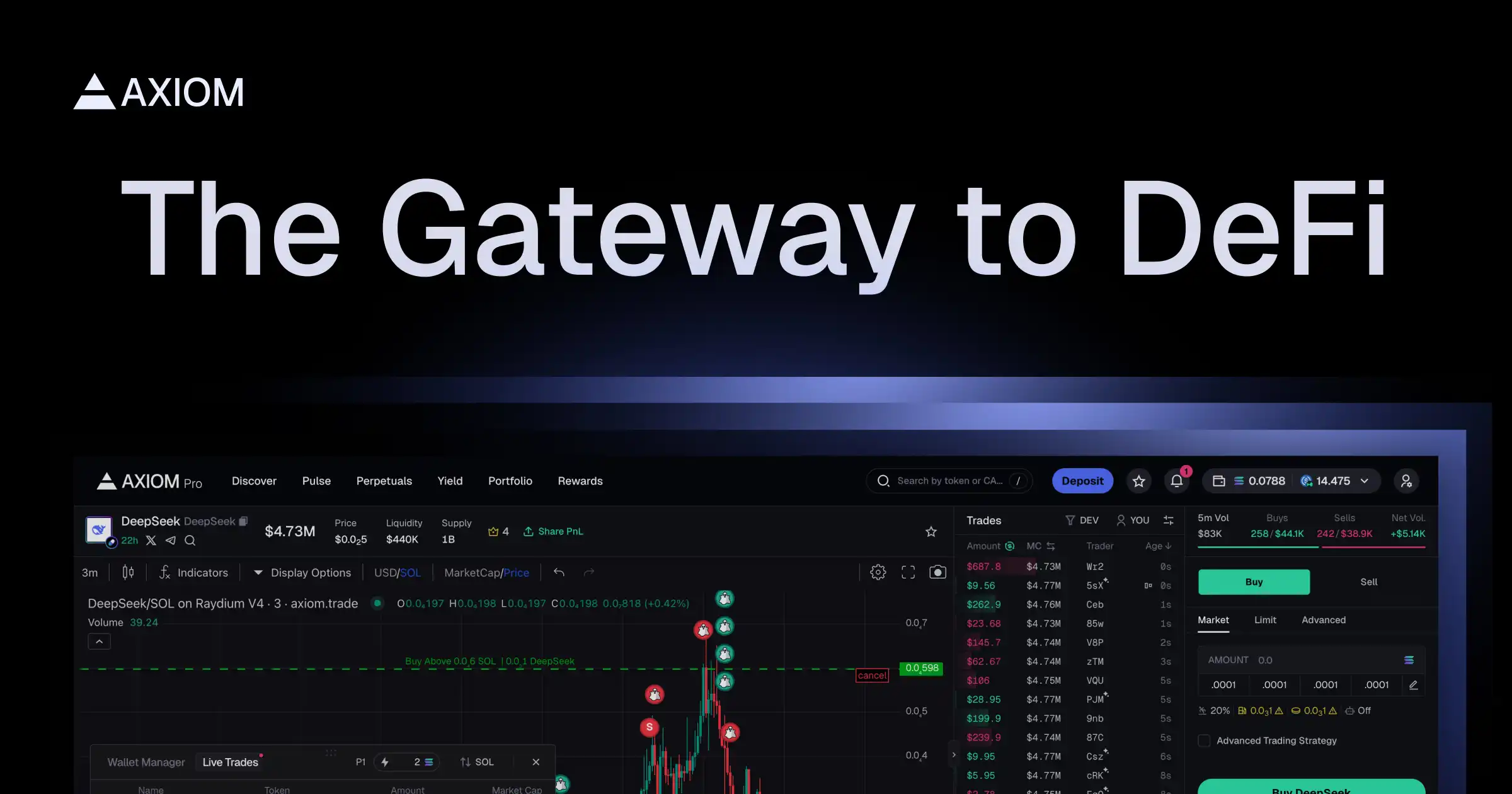

For traders focused on emerging memecoins and trending tokens, Axiom.trade provides specialized features:

- Zero KYC requirements for all trading tiers

- Early access to new memecoin launches

- Advanced trading bots for automated strategies

- Competitive fee structure with discounts for high-volume traders

- Seamless cross-chain trading capabilities

Check out Axiom.trade for memecoin trading without identity verification.

Ox.fun brings a unique approach to no KYC trading with its gamified platform:

- Complete anonymity for all users

- Gamified trading competitions with crypto rewards

- Social trading features to follow successful traders

- Low transaction fees and high withdrawal limits

- Innovative user interface with trading analytics

Explore Ox.fun for a gamified crypto trading experience.

4. GMGN: AI-Powered Trading Without KYC

GMGN leverages artificial intelligence to enhance the trading experience while maintaining privacy:

- No identity verification requirements

- AI-powered trading signals and market analysis

- Smart portfolio management tools

- Multi-chain support for diverse asset trading

- Advanced security protocols with regular audits

Visit GMGN to experience AI-enhanced anonymous trading.

5. Best Wallet: Simplicity Meets Privacy

Best Wallet offers a straightforward approach to no KYC crypto trading:

- Simple registration with just an email address

- Direct crypto purchases using credit/debit cards

- Integrated non-custodial wallet functionality

- Competitive fees with transparent pricing

- Strong focus on security and user privacy

Check out Best Wallet for a simplified trading experience.

Security Considerations for No KYC Exchanges

While no KYC exchanges offer privacy benefits, users should consider several security factors:

Two-Factor Authentication (2FA)

Always enable 2FA on your exchange accounts to add an extra layer of security beyond your password. This significantly reduces the risk of unauthorized access.

Cold Storage Options

Prioritize exchanges that store the majority of user funds in cold wallets (offline storage), which provides better protection against hacking attempts.

Platform Reputation and History

Research the exchange’s track record, including any past security incidents, how they were handled, and the platform’s longevity in the market.

Regular Security Audits

Top no KYC exchanges conduct regular third-party security audits and publicly share the results to demonstrate their commitment to security.

Insurance Policies

Some exchanges offer insurance coverage for digital assets, providing additional protection against potential losses from security breaches.

Legal Considerations for No KYC Trading

Understanding the legal landscape surrounding no KYC exchanges is crucial:

Regulatory Compliance

While these exchanges minimize identity verification, many still implement basic compliance measures to prevent illegal activities. Users should understand that complete anonymity may not be guaranteed.

Jurisdictional Restrictions

Depending on your location, using no KYC exchanges may have different legal implications. Always research the regulations in your jurisdiction before trading.

Tax Reporting Obligations

Even when trading on no KYC platforms, users typically remain responsible for reporting cryptocurrency transactions for tax purposes according to their local laws.

Anti-Money Laundering (AML) Policies

Most reputable no KYC exchanges still implement some form of AML monitoring to detect suspicious activities, even without collecting personal information.

How to Choose the Right No KYC Exchange

Consider these factors when selecting a no KYC exchange:

Trading Volume and Liquidity

Higher trading volume generally indicates better liquidity, which means you can execute trades more efficiently without significant price slippage.

Available Cryptocurrencies

Ensure the exchange supports the specific cryptocurrencies you want to trade. Some no KYC platforms offer hundreds of options, while others focus on major coins.

Fee Structure

Compare trading fees, withdrawal fees, and any other charges that might impact your trading profitability. Some exchanges offer tiered fee structures based on trading volume.

User Experience

A well-designed, intuitive interface can significantly improve your trading experience, especially for beginners. Look for platforms with comprehensive educational resources.

Customer Support

Responsive customer support is crucial when issues arise. Test the exchange’s support channels before committing to significant trading activity.

Best Practices for Using No KYC Crypto Exchanges

To maximize security and efficiency when using no KYC exchanges:

Use Strong, Unique Passwords

Create complex passwords unique to each exchange account, and consider using a password manager to keep track of them securely.

Implement Additional Privacy Measures

Consider using a VPN (Virtual Private Network) for an extra layer of privacy when accessing cryptocurrency exchanges.

Regularly Transfer Funds to Private Wallets

Avoid keeping large amounts of cryptocurrency on exchange platforms. Instead, transfer funds to private, non-custodial wallets when not actively trading.

Monitor Account Activity

Regularly check your account for any unauthorized or suspicious activities, and enable notifications for all transactions.

Stay Informed About Regulatory Changes

Cryptocurrency regulations evolve rapidly. Stay updated on regulatory developments that might affect no KYC exchanges in your jurisdiction.

The Future of No KYC Crypto Exchanges

As regulatory pressures increase globally, the landscape for no KYC exchanges continues to evolve. Several trends are shaping the future:

Decentralized Exchange Growth

Decentralized exchanges (DEXs) are gaining popularity as they inherently offer more privacy than centralized alternatives. This trend is likely to continue as DEX technology improves.

Balanced Approach to Compliance

Many exchanges are developing innovative solutions that balance privacy with regulatory requirements, such as zero-knowledge proof systems that verify information without revealing it.

Enhanced Security Measures

As technology advances, no KYC exchanges are implementing more sophisticated security protocols to protect user funds and data without compromising on privacy.

Integration with DeFi Ecosystems

No KYC exchanges are increasingly integrating with broader decentralized finance (DeFi) ecosystems, offering users access to lending, staking, and other financial services without identity verification.

Conclusion

No KYC crypto exchanges provide valuable options for privacy-conscious traders in 2025. Platforms like LBank, Axiom.trade, Ox.fun, GMGN, and Best Wallet offer various approaches to anonymous trading, each with unique features and benefits.

When choosing a no KYC exchange, carefully consider factors such as security measures, available cryptocurrencies, fee structures, and legal implications in your jurisdiction. By following best practices and staying informed about the evolving regulatory landscape, you can enjoy the privacy benefits of no KYC trading while minimizing potential risks.

Remember that while privacy is important, responsible trading practices and awareness of legal obligations remain essential components of a successful cryptocurrency trading strategy.

Read More: